Triangle Community Foundation is one of North Carolina’s largest community foundations. We are made up of more than 800 charitable funds established by individuals, families, companies, nonprofits, and private foundations. Our capacity to serve the community is directly tied to our ability to preserve and enhance our financial assets.

We invite you to download and review the following financial documents, and reach out to us with any questions that you may have.

2023 Audit Report | FY 22-23 Financial Report | 501(c)(3) Determination Letter | Whistleblower Policy | 2021 Form 990 and 990-T

Investments at the Foundation

Our Board of Directors has developed investment policies and guidelines that provide for prudent asset management. An Investment Committee, comprised of board members and volunteers knowledgeable in the investment field, oversees the investment activities of the Foundation, together with independent investment advisor Crewcial Partners LLC. We invite you to review the last quarter’s overview.

Our Investment Philosophy

Triangle Community Foundation's investment philosophy is intended to protect the value of charitable funds while they are being held for future distribution. The Foundation’s investment portfolio is made up of diversified pools managed by specialized investment managers. Selection of an investment pool will vary depending on the timeframe for giving, level of diversification desired, and charitable goals of the donor.

Endowed funds are permanent funds invested for the long-term in a diversified portfolio of publicly traded stocks, bonds, real estate, private equity, hedge funds and cash. Endowed funds are operated under a spending policy set by The Foundation and guided by the North Carolina Uniform Prudent Management of Institutional Funds Act (UPMIFA). Currently up to 4% of an endowed fund’s value is available for distribution in the form of grants on an annual basis. Non-endowed funds are also invested for the long-term, but do not have a limitation on distributions and therefore have cash flow needs requiring greater flexibility.

Our Investment Purpose

The Investment Committee and Investment Advisor implement a sound investment policy for the Foundation that results in the most suitable investments for each type of investment portfolio. A key goal is to achieve investment returns that are high enough to permit annual distributions from endowment funds while generating real, net‐of‐inflation results that will maintain the purchasing power of the underlying funds across generations.

Our Investment Goals

- To earn long-term returns sufficient to exceed inflation and grant distributions

- To earn returns that meet targeted performance benchmarks

- To achieve these results while taking prudent levels of risk

Our Investment Offerings

We offer two types of investment portfolios at the Foundation, endowed and non-endowed.

Endowed Investment Portfolio

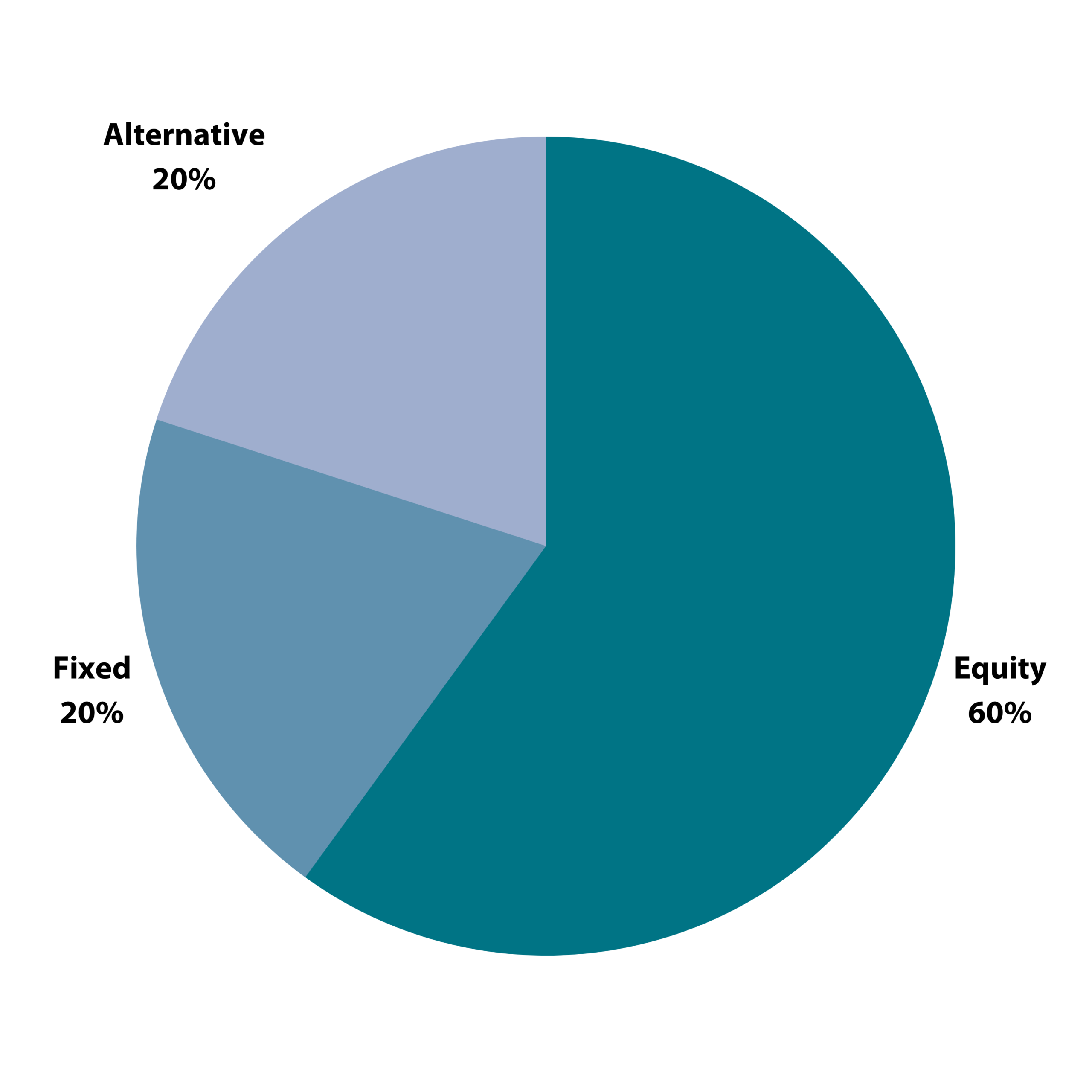

Under our present investment strategy, the Foundation has one endowed portfolio. Because we can predict the cash distributions required of endowed funds (4%), assets in the endowed portfolios can be invested in a greater range of asset classes, some of which are less liquid than others, to help balance risk and return more effectively.

Non-Endowed Investment Portfolio

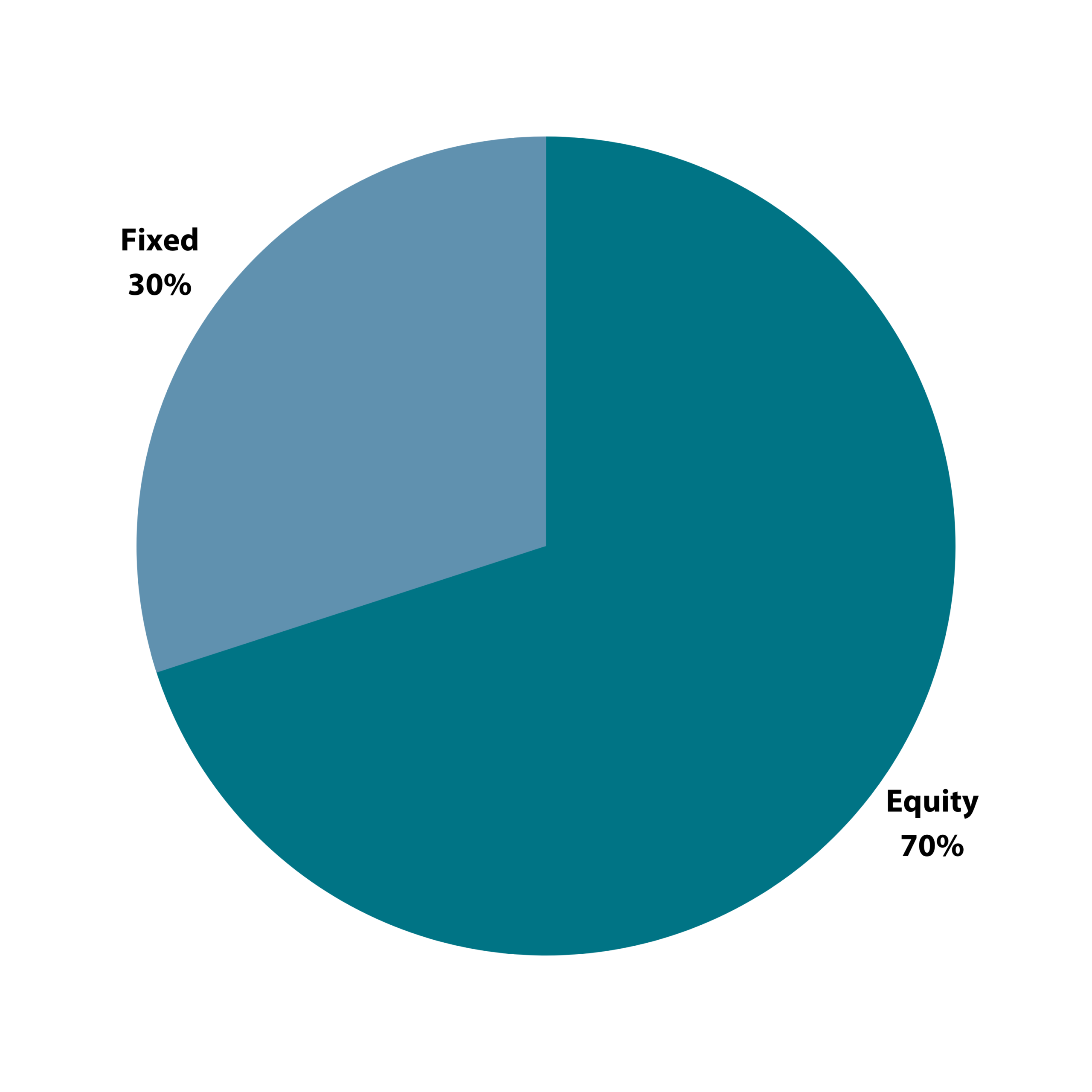

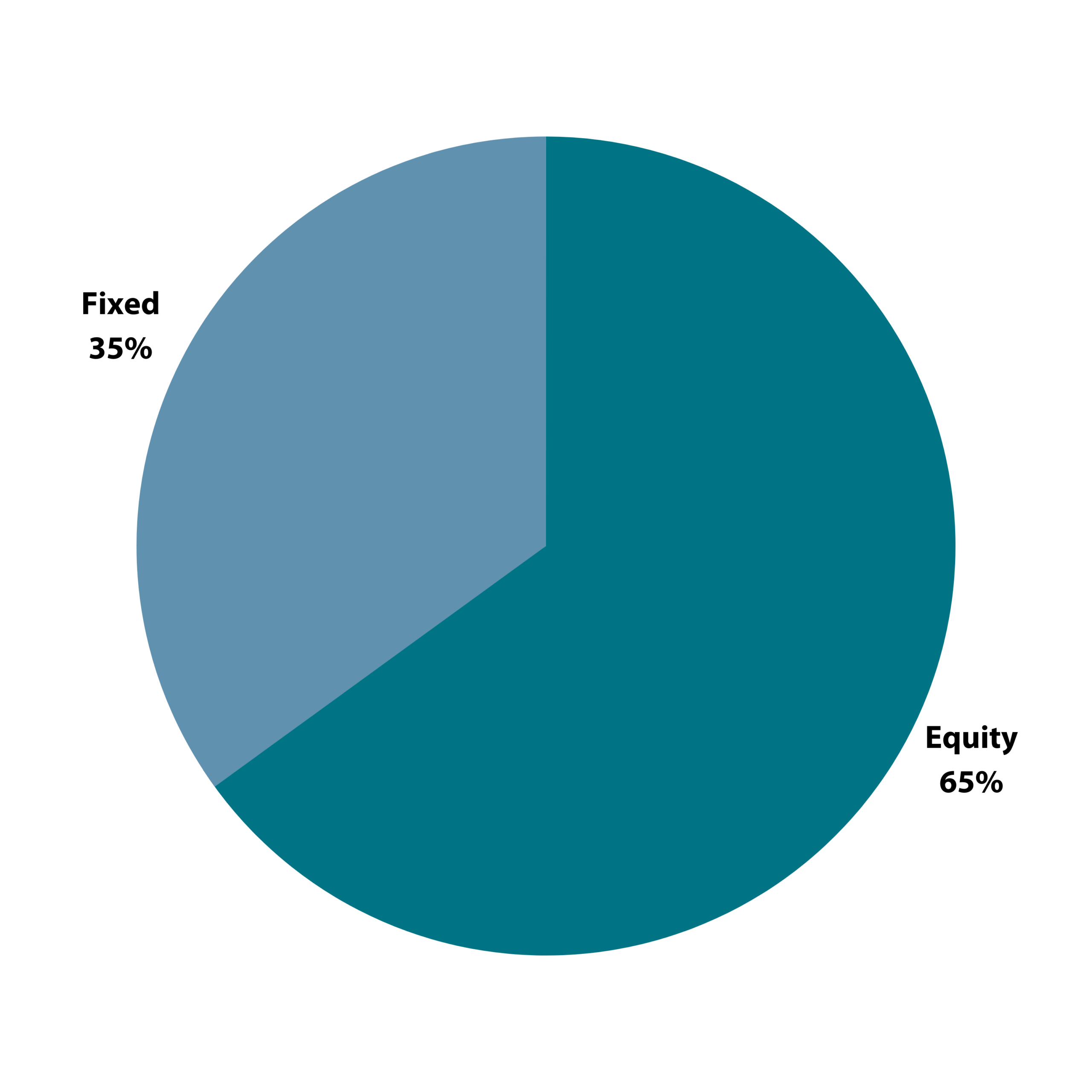

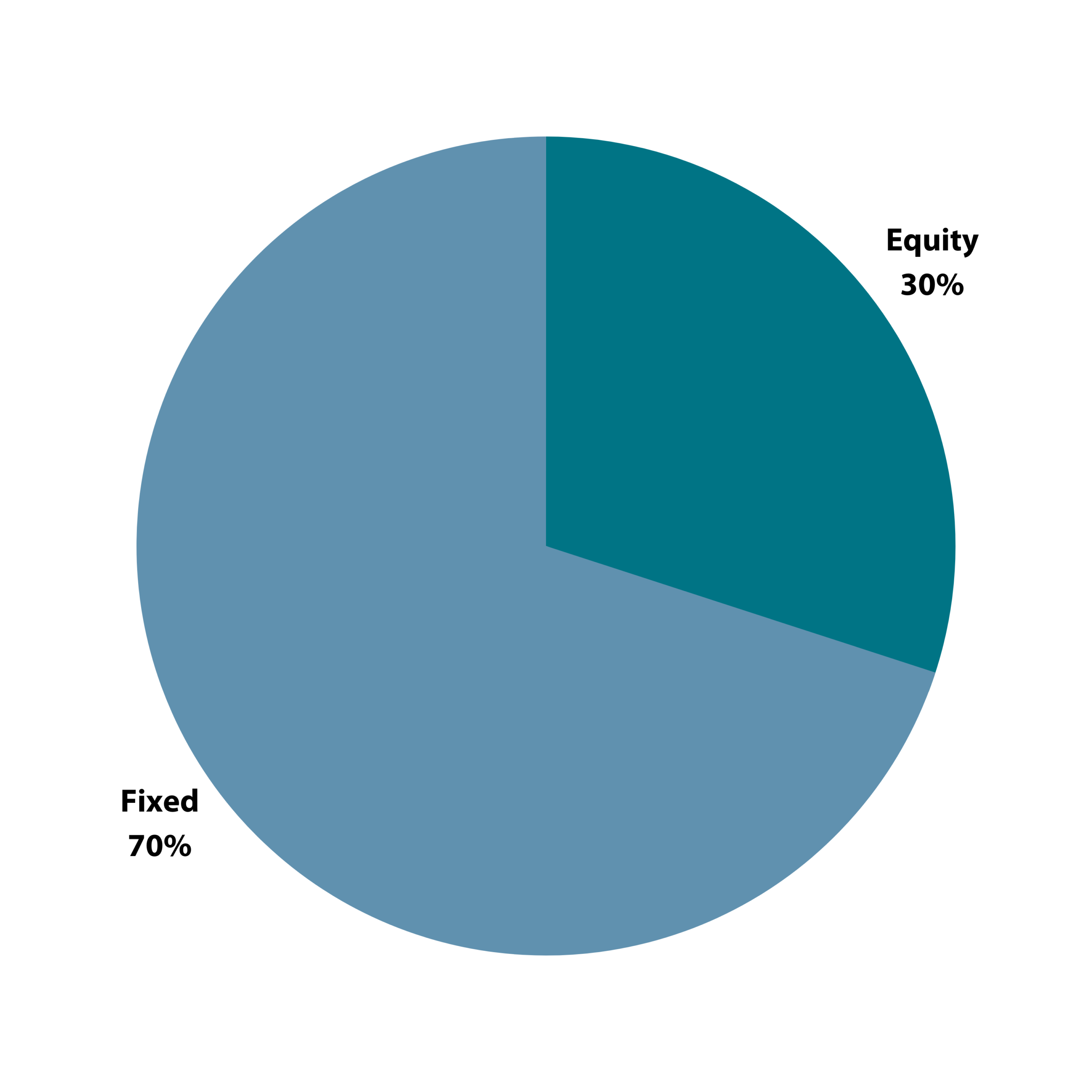

Non-endowed funds may choose between several portfolios. The Equity-Oriented Portfolio is similar to the Endowed Portfolio, but does not have any exposure to alternative investments. Because there is no limitation on distributions from non-endowed funds, there is a need to maintain liquidity. Non-endowed fundholders have the opportunity to change their investment option once a year.

Investment Oversight

The Foundation has a Finance Committee composed of board members having specific experience and expertise in financial management and operations. Further, there is an Investment Committee consisting of experienced career investment professionals. This group sets investment objectives, selects investment managers assigned to particular portions of foundation portfolios, and monitors performance with the goal of achieving targeted returns while maintaining an appropriate level of risk.

An Investment Advisor works with the Investment Committee to identify potential money managers for consideration of the committee. Together, the Investment Committee and Investment Advisor develop sound investment policy and appropriate asset allocations for each of the investment portfolios.

The Board of Directors provides oversight of the investments and directs the staff to apply the investment policies it has adopted as described above.

Foundation staff perform accounting and treasury management, including the allocation of gains and losses from an investment pool to individual funds participating in that investment portfolio, initiation of money transfers between investment accounts, overall enterprise financial oversight, and fund reporting.